Tax-Effective Exit Strategies: Building a Business with Future Success in Mind

Joseph and John have a shared vision: to start a successful business venture together. As they embark on this new journey, they are thinking strategically about how to structure their business to achieve not only immediate success but also a tax-effective exit strategy in the future. They want a business structure that offers fixed ownership interests and fixed income distribution, ensuring clarity and fairness in their partnership. Additionally, they are planning for a potential sale of the business and want to ensure they can maximise their returns while minimising tax liabilities. A unit trust offers an ideal solution. In this blog, we’ll explore how Joseph and John can use a unit trust to meet their business goals, providing a clear path to a tax-efficient exit strategy.

The Challenge: Structuring for Fixed Interests and Future Exit

When starting a business together, Joseph and John have two primary objectives:

- Fixed Ownership and Income Distribution: They want a structure that clearly defines their ownership interests and how income and profits are distributed. This ensures that each partner knows exactly what their entitlements are, reducing the potential for disputes and misunderstandings.

- Tax-Effective Exit Strategy: Joseph and John are planning for the future. While they are committed to building a successful business, they also recognise that they may want to sell the business down the line. They need a structure that allows them to take advantage of capital gains tax (CGT) concessions, ensuring a tax-effective outcome when they decide to exit.

The Solution: Using a Unit Trust for Business Operations and Future Sale

To meet these objectives, Joseph and John can establish a unit trust for their business venture. This approach offers several key benefits that align with their goals:

- Establishing a Unit Trust with Fixed Ownership:

Joseph and John can set up a unit trust, with each holding an equal number of units (50/50). Alternatively, they can have their respective family trusts hold the units on their behalf, maintaining the 50/50 ownership split. This structure clearly defines their ownership interests, ensuring that both partners have equal rights to the business’s income and capital. - Fixed Entitlements to Income and Capital:

In a unit trust, the entitlements to income and capital gains are fixed according to the number of units held. With Joseph and John each holding 50% of the units, they have equal entitlement to the business’s income and any capital gains. This provides clarity and fairness in their partnership, ensuring that profits are shared equally and reflecting their equal investment in the business. - Tax-Effective Exit Through the 50% CGT Discount:

One of the significant advantages of using a unit trust is access to the 50% CGT discount. When the business is eventually sold, a unit trust that meets the eligibility requirements can reduce the capital gain by 50%. This is a substantial benefit that is not available to companies. If Joseph and John had structured their business as a company, the company would not be eligible for this discount, resulting in a higher tax liability on the sale. By using a unit trust, they can significantly reduce the amount of tax payable, maximising their net proceeds from the sale.

Key Considerations for Using a Unit Trust in Business

While a unit trust provides significant benefits for Joseph and John, there are important considerations to ensure the trust is set up and managed effectively:

- Eligibility for CGT Discount:

To access the 50% CGT discount, the trust must meet specific eligibility requirements set by the Australian Taxation Office (ATO). This includes holding the business asset for at least 12 months. Joseph and John should work with tax advisors to ensure their business structure meets these requirements and is positioned to take full advantage of the discount. - Legal and Tax Advice:

Setting up a unit trust involves navigating legal, tax, and administrative complexities. Joseph and John should consult with legal and financial professionals to ensure the trust is structured correctly, complies with all relevant regulations, and aligns with their long-term business goals. - Drafting the Trust Deed:

The trust deed is a critical document that outlines the rules of the trust, including the rights and obligations of the unitholders, distribution of income, and management of the trust. A well-drafted deed ensures that the trust operates smoothly and in the best interests of both partners. - Ongoing Compliance and Management:

Managing a unit trust requires attention to record-keeping, tax reporting, and compliance with legal obligations. Joseph and John should ensure that the trust operates transparently and that all income, expenses, and distributions are properly documented.

The Benefits: Clear Ownership and Tax Efficiency

By using a unit trust, Joseph and John can achieve a balanced approach to their business strategy, combining fixed ownership interests with a tax-effective exit strategy:

- Clarity and Fairness: The fixed entitlements in a unit trust provide clear ownership and income distribution rights, ensuring that both Joseph and John benefit equally from their investment.

- Tax Efficiency Through CGT Discount: Access to the 50% CGT discount allows Joseph and John to reduce their tax liability on a future sale, maximising their net proceeds and ensuring a tax-efficient exit.

- Strategic Flexibility: A unit trust provides a flexible structure that can adapt to the changing needs of the business and its owners, supporting long-term growth and planning for future exits.

Conclusion: Planning for Success with Unit Trusts

For business partners like Joseph and John, structuring a business venture with future success in mind is crucial. By using a unit trust, they can ensure fixed ownership interests, clear income distribution, and a tax-effective exit strategy. This approach not only provides fairness and clarity in their partnership but also maximises their financial outcomes when they decide to sell the business. With the right structure and planning, Joseph and John can build a successful business and secure a prosperous future.

If you’re considering starting a business and want to plan for a tax-effective exit, consulting with legal and financial professionals about setting up a unit trust can provide the guidance you need. With the right advice, you can ensure that your business is structured for success and that your hard work pays off in the long run.

Others

-

October 20, 2025 Buying Property Under Your Personal Name in Australia: Pros and Cons

-

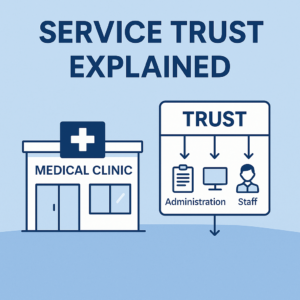

October 18, 2025 Service Trust Business Structure in Australia