Protecting Your Property Portfolio: A Guide to Asset Protection for Landlords

Owning a property portfolio can be a lucrative investment strategy, offering a steady income stream and the potential for long-term capital growth. However, with property ownership comes the inherent risk of legal issues, especially when tenants are involved. If you, like John, have a significant property portfolio under your name, the concern about potential lawsuits from tenants is real and justified. In this blog post, we will explore how using a discretionary trust can provide a layer of asset protection for new investments, ensuring your property portfolio remains secure.

The Risks: Legal Liability as a Landlord

As a landlord, John faces various risks associated with owning multiple properties. From maintenance issues to tenant disputes, there are numerous scenarios where a tenant might file a lawsuit. Some common reasons tenants may sue landlords include:

- Property maintenance failures leading to injury or damage

- Breach of contract claims

- Disputes over security deposits

- Allegations of discrimination or harassment

If any of these issues were to escalate to a legal battle, John’s personal assets could be exposed to potential claims, given that his properties are currently under his name. The more properties and tenants involved, the higher the risk of facing legal challenges.

The Solution: Using a Discretionary Trust for New Investments

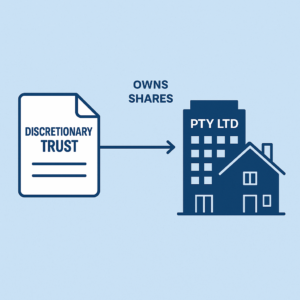

John’s concern is valid, but fortunately, there are strategies to mitigate these risks for future investments. One effective approach is establishing a discretionary trust. This legal structure offers significant asset protection benefits, making it a popular choice for property investors. Here’s how it can work for John:

- Establishing a Discretionary Trust: John can set up a discretionary trust to purchase new investment properties. By doing this, any new properties will be owned by the trust rather than John personally. A trustee, which could be a trusted individual or a corporate entity, manages the trust. John and his family can be beneficiaries, but they do not directly own the assets.

- Legal Separation of Assets: By holding new properties in a discretionary trust, John creates a legal separation between his personal assets and his investments. This means that if a tenant were to sue, it would be more difficult for them to claim against his personal assets. The properties owned by the trust are not seen as part of John’s personal wealth, providing a protective barrier.

- Accumulate New Properties Safely: As John continues to grow his property portfolio, he can purchase additional properties through the trust. This strategy allows him to keep expanding his investments while maintaining a level of asset protection. The trust can hold various types of properties, from residential to commercial, without exposing John’s personal wealth to the associated risks.

Considerations: Tax Implications and Existing Properties

While the use of a discretionary trust offers substantial protection for new investments, John must carefully consider the tax implications, especially regarding his existing properties:

- Capital Gains Tax (CGT) and Stamp Duty: Transferring existing properties into the trust could trigger CGT and stamp duty, as these transfers are treated as a sale or disposal for tax purposes. This can result in significant tax liabilities, which is why John should primarily use the trust for acquiring new properties.

- Alternative Strategies for Existing Properties: For the properties John already owns, it might be impractical to move them into the trust due to potential tax implications. However, there are other strategies he can explore to protect these assets:

- Insurance: Ensuring he has comprehensive landlord insurance can provide coverage for potential claims related to tenant disputes, property damage, and liability issues.

- Corporate Structure: John could consider setting up a company to hold his existing properties, which might offer some degree of protection, though not as strong as a trust.

- Legal Agreements: Strengthening rental agreements and ensuring thorough screening processes for tenants can reduce the likelihood of disputes and litigation.

Conclusion: Proactive Asset Protection for Peace of Mind

For landlords like John, managing the risks associated with property ownership is crucial to safeguarding wealth. By establishing a discretionary trust for new investments, John can continue to grow his property portfolio while protecting his personal assets from potential legal claims. This proactive approach not only provides peace of mind but also ensures that his investments are secure for the future.

However, asset protection requires careful planning and consideration of all factors, including tax implications. Seeking advice from legal and accounting professionals is essential to implement a strategy that aligns with your financial goals and risk profile. Whether you’re a seasoned property investor or just starting, understanding and utilising the right asset protection tools is key to long-term success.

Others

-

October 20, 2025 Buying Property Under Your Personal Name in Australia: Pros and Cons

-

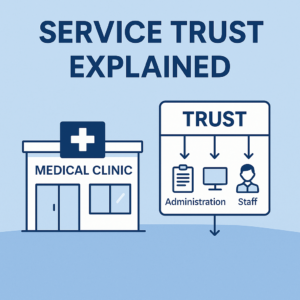

October 18, 2025 Service Trust Business Structure in Australia