Maximising Tax Efficiency: How Business Owners Can Use Discretionary Trusts to Manage Profits

Sarah runs a successful retail business structured as a company, with herself as the sole shareholder. Her hard work has paid off, and even after paying herself a market salary, the business still generates substantial profits. While this is an excellent position to be in, Sarah is now faced with a common dilemma for business owners: how to take these profits out of the business in a tax-effective way. To reduce her overall tax burden and maximise the benefits for her family, Sarah can consider using a discretionary trust. In this blog, we’ll explore how a discretionary trust can help business owners like Sarah manage their profits more tax-efficiently.

The Challenge: Taking Profits Out of a Business Tax Effectively

As the sole shareholder of her company, Sarah has already compensated herself with a market salary for her role in the business. However, the business still has significant profits after her salary is accounted for. If Sarah were to take these profits directly as dividends, she would be subject to her personal marginal tax rate, which could be quite high given her income level. Paying a high rate of tax on these additional profits would significantly reduce the overall benefit to Sarah and her family.

Sarah is looking for a way to distribute these profits that not only aligns with tax regulations but also minimises the tax impact, allowing her to retain more of the business’s hard-earned money within her family.

The Solution: Using a Discretionary Trust to Optimise Tax Efficiency

To manage the profits more tax-effectively, Sarah can set up a discretionary trust and restructure her business accordingly. Here’s how this can be done:

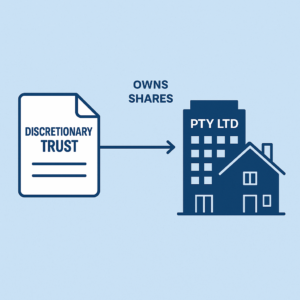

- Setting Up a Discretionary Trust:

Sarah establishes a discretionary trust and restructures her business so that the discretionary trust becomes the shareholder of her company. Alternatively, if restructuring the entire business is not feasible, Sarah can change the shareholder of her company from herself to the discretionary trust. This simple change in the ownership structure of the company can provide significant tax benefits. - Distribution of Profits Through the Trust:

Once the discretionary trust is in place as the shareholder, the company can distribute profits to the trust. The trust then has the discretion to allocate these profits to various beneficiaries, such as Sarah’s spouse or adult children. By distributing the profits to family members who are in lower tax brackets, the overall tax burden on the profits is reduced. This allows the family to take advantage of lower marginal tax rates, maximising the after-tax income that stays within the family. - Flexibility in Income Distribution:

One of the key benefits of using a discretionary trust is its flexibility. The trustee has the discretion to decide how income is distributed among the beneficiaries. This means Sarah can adjust the distributions each year based on the beneficiaries’ circumstances, income needs, and tax positions. This adaptability ensures that the income distribution is always optimised for tax efficiency.

Key Considerations: Ensuring Compliance and Maximising Benefits

While using a discretionary trust offers significant tax advantages, Sarah must consider several factors to ensure compliance and maximise the benefits:

- Professional Advice: Setting up and managing a discretionary trust involves legal and tax complexities. Sarah should seek advice from legal and accounting professionals to ensure that the trust is set up correctly, complies with all regulations, and aligns with her overall financial strategy.

- Franking Credits: When the company pays tax on its profits, it may attach franking credits to the dividends distributed to the trust. These franking credits can be passed on to the beneficiaries, reducing their personal tax liability further. Understanding how franking credits work and how they can be utilised is essential for effective tax planning.

- Trust Deed and Beneficiaries: Sarah should carefully draft the trust deed to define the range of potential beneficiaries. While she might initially plan to distribute income to her spouse and adult children, the trust deed should allow flexibility to include future beneficiaries, such as grandchildren or other family members.

- Avoiding Anti-Avoidance Provisions: Tax authorities are vigilant about arrangements that are purely for tax avoidance. Sarah should ensure that the trust is used for legitimate business and family wealth management purposes. Proper documentation and clear records of income distributions will help demonstrate the genuine nature of the trust’s operations.

The Benefits: Reduced Tax Burden and Enhanced Family Wealth

By using a discretionary trust, Sarah can achieve several key benefits:

- Tax Savings: Distributing profits to beneficiaries in lower tax brackets significantly reduces the overall tax burden on the business’s profits, leading to substantial tax savings.

- Family Wealth Management: The discretionary trust provides a vehicle for managing and distributing family wealth. This not only helps in tax planning but also in ensuring that family members are supported financially in a structured way.

- Flexibility and Control: The trustee’s discretion over income distribution allows Sarah to adapt to changing circumstances, ensuring that income is allocated where it’s needed most and in the most tax-effective manner.

Conclusion: Leveraging Discretionary Trusts for Tax Efficiency

For business owners like Sarah, managing profits in a tax-effective way is crucial to maximising the financial benefits of their hard work. By setting up a discretionary trust and using it to distribute profits, Sarah can significantly reduce her tax liabilities and enhance the wealth and financial security of her family. This strategy not only offers tax advantages but also provides flexibility and control over how family wealth is managed.

If you are a business owner looking to optimise your tax strategy, consider consulting with legal and tax professionals to explore the use of discretionary trusts. With the right advice and planning, you can maximise your business’s profitability and secure a strong financial future for your family.

Others

-

October 20, 2025 Buying Property Under Your Personal Name in Australia: Pros and Cons

-

October 18, 2025 Service Trust Business Structure in Australia