Asset Protection for Professionals in High-Risk Occupations: The Benefits of a Discretionary Trust

Working in a highly litigious profession, such as a surgeon, lawyer, or construction site supervisor, comes with both rewards and significant risks. Professionals in these fields are often more vulnerable to lawsuits and legal claims, which can have substantial financial implications. To safeguard personal wealth from potential professional liabilities, it is essential to have robust asset protection strategies in place. This blog explores how John, a professional in a high-risk occupation, can use a discretionary trust to protect his investments and ensure his financial security.

Understanding the Risks: Why Professionals Need Asset Protection

Professionals like John, who work in occupations with a higher likelihood of litigation, face a constant risk of legal claims that could arise from their professional activities. These claims can lead to substantial financial settlements or judgments. If John holds his investments and assets in his personal name, they could be exposed to these claims, putting his hard-earned wealth at risk. Therefore, it is crucial for professionals in high-risk fields to adopt strategies that protect their personal assets from potential legal actions.

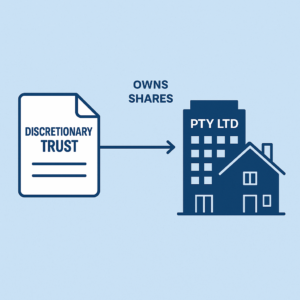

The Solution: Using a Discretionary Trust for Asset Protection

One of the most effective ways for John to protect his investments is by establishing a discretionary trust. A discretionary trust is a legal arrangement that can help shield his assets from creditors and legal claims. Here’s how John can use a discretionary trust to his advantage:

- Setting Up the Trust: John creates a discretionary trust to hold his new investment assets. The trust is managed by a trustee, who has the discretion to manage and distribute the assets to the beneficiaries, which can include John, his family members, or other individuals. Since the assets are owned by the trust and not directly by John, they are more difficult for creditors to access.

- Separation of Ownership: By placing his new investments into the discretionary trust, John effectively separates these assets from his personal ownership. This legal separation provides a protective barrier, making it challenging for creditors to claim these assets in the event of a lawsuit or legal action against John.

- Accumulating Wealth Safely: Over time, John can use the trust to accumulate various types of investment assets, such as stocks, bonds, real estate, or other income-generating properties. As these assets are held within the trust, they remain insulated from any legal claims that might arise from John’s professional activities.

Key Considerations: Tax Implications and Existing Assets

While a discretionary trust offers valuable protection, there are important tax considerations and strategies to keep in mind:

- Capital Gains Tax (CGT) and Stamp Duty: If John decides to transfer his existing assets into the discretionary trust, this could trigger CGT and stamp duty, as the transfer is considered a disposal for tax purposes. This might result in a significant tax liability, which is why it’s advisable for John to use the trust primarily for new investments.

- Planning for Existing Assets: For assets that John already owns personally, alternative strategies might be needed to protect them without incurring negative tax implications. These strategies could include using insurance products, restructuring asset ownership, or employing other legal mechanisms designed for asset protection.

- Tax Efficiency: In addition to asset protection, discretionary trusts can offer tax planning advantages. The trustee’s discretion to distribute income can allow John to optimize tax outcomes by distributing income to beneficiaries in lower tax brackets, thereby potentially reducing the overall tax burden for his family.

Conclusion: Safeguarding Wealth for Professionals

For professionals like John, working in highly litigious occupations, protecting personal wealth is not just a concern—it’s a necessity. Establishing a discretionary trust is a powerful tool to ensure that his investments and assets are protected from potential legal claims and creditors. This strategy provides John with peace of mind, knowing that his financial future is secure, regardless of the professional risks he faces.

If you are a professional in a high-risk occupation and are considering asset protection strategies, consulting with legal and accounting professionals is crucial. They can help you navigate the complexities of setting up a trust and provide guidance on the best approach to protecting your wealth, ensuring your long-term financial security.

Others

-

October 20, 2025 Buying Property Under Your Personal Name in Australia: Pros and Cons

-

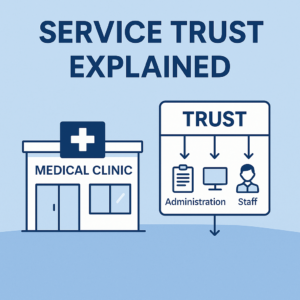

October 18, 2025 Service Trust Business Structure in Australia