Minimising Tax Liabilities: How Trusts Can Help You Retain More Wealth

Tax planning is a crucial part of building and preserving wealth. In Australia, trusts can be powerful tools for minimising tax liabilities, helping families and individuals keep more of their income, capital gains, and investment returns. Whether you’re looking to reduce income tax, manage capital gains, or pass on wealth efficiently to future generations, structuring your assets through a trust can provide significant tax benefits.

How Trusts Minimise Tax Liabilities

Trusts offer flexibility in distributing income and capital gains to beneficiaries, making them an effective vehicle for tax planning. Here are some key ways trusts can help reduce your overall tax burden:

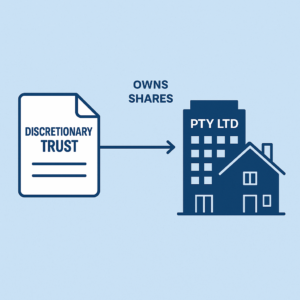

- Income Splitting: A discretionary trust allows the trustee to distribute income to beneficiaries who are in lower tax brackets. For example, if a family has children who are over 18 and have minimal other income, distributing some trust income to them can reduce the total tax paid by the family. This strategy helps spread income across multiple taxpayers, taking advantage of the lower marginal tax rates.

- Capital Gains Tax (CGT) Management: Trusts can be structured to hold investments or property that are expected to appreciate in value. When these assets are sold, the trust can distribute the capital gains to beneficiaries in a tax-efficient manner. Trusts are also eligible for the 50% CGT discount when assets are held for more than 12 months, further reducing the tax impact.

- Minimising Estate Taxes and Probate Costs: Placing assets in a trust can help avoid estate taxes and probate costs upon death, as assets in a trust are not considered part of the deceased’s personal estate. This means they can be passed on to beneficiaries without attracting estate taxes or delays associated with probate.

- Tax-Effective Investment Strategies: Trusts can invest in assets that provide tax-effective returns, such as franking credits on shares. The trust can distribute dividends and the associated franking credits to beneficiaries, who can then offset these credits against their tax liabilities, reducing their tax payable.

Real-World Examples of Using Trusts to Minimise Taxes

- Income Splitting for a Property Investment Family: David and Emma are high-income earners and own several investment properties. By setting up a discretionary family trust, they can distribute rental income to their two adult children, who are in lower tax brackets because they are university students with minimal other income. This strategy reduces the family’s overall tax liability, allowing David and Emma to keep more of the rental income.

- Managing Capital Gains Tax on the Sale of Shares: Michael, a successful investor, holds a significant portfolio of shares through a trust. When he sells a portion of his shares for a profit, the capital gain is realised within the trust. Michael distributes the gain to his retired parents, who have no other sources of income and fall into a lower tax bracket. This approach minimises the capital gains tax impact compared to if Michael had realised the gain in his personal name.

- Reducing Estate Taxes with a Testamentary Trust: Jane wants to ensure her wealth is passed on to her children efficiently. By establishing a testamentary trust in her will, she can pass on her assets in a tax-effective manner. The trust’s income can be distributed to her children and grandchildren at adult marginal tax rates, rather than punitive penalty rates usually applied to minors, reducing the family’s tax burden and preserving more of the estate’s wealth.

Key Benefits of Using a Trust to Minimise Tax Liabilities

- Flexibility in Income Distribution: Distribute income and capital gains to beneficiaries in a way that maximises tax efficiency, taking advantage of different marginal tax rates.

- Capital Gains Tax Benefits: Trusts can access the 50% CGT discount if assets are held for over 12 months, reducing the capital gains tax payable.

- Estate Planning and Succession: Trusts can pass assets to beneficiaries tax-effectively, avoiding estate taxes and probate costs.

- Investment Tax Efficiency: Trusts can be structured to invest in tax-efficient assets, such as shares with franking credits, providing beneficiaries with tax offsets.

Others

-

October 20, 2025 Buying Property Under Your Personal Name in Australia: Pros and Cons

-

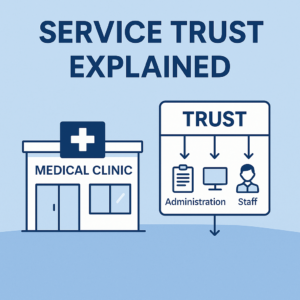

October 18, 2025 Service Trust Business Structure in Australia