Holding Tangible and Intangible Assets: How Trusts Can Secure and Grow Your Wealth

September 28, 2024

Whether it’s real estate, investments, or intellectual property, trusts can play a critical role in protecting and growing your wealth. In Australia, trusts offer an efficient and flexible way to hold both tangible and intangible assets, providing asset protection, tax advantages, and an effective means for estate planning.

What Are Tangible and Intangible Assets?

- Tangible Assets: These are physical items that can be seen and touched, such as property, machinery, vehicles, and furniture. Tangible assets are typically used in a business or held as personal property investments, such as rental properties or commercial real estate.

- Intangible Assets: These include non-physical assets that hold value, such as intellectual property (IP), patents, copyrights, trademarks, shares, and digital assets. Intangible assets are often central to the operations of modern businesses and can represent a significant portion of a company’s value.

Why Use Trusts to Hold Tangible and Intangible Assets?

- Asset Protection: Holding assets in a trust separates personal ownership from business ownership, providing an additional layer of protection. This is particularly useful for business owners or investors in high-risk industries. If personal financial troubles arise, assets within the trust are generally not accessible to personal creditors.

- Tax Efficiency: Trusts offer flexibility in distributing income from assets, which can minimise overall tax liability. For example, rental income from an investment property held in a trust can be distributed to family members in lower tax brackets, resulting in lower taxes.

- Efficient Succession Planning: Assets held in a trust can be seamlessly transferred to beneficiaries according to the terms set out in the trust deed. This avoids potential delays, legal complications, and costs associated with probate when passing assets to the next generation.

- Management and Control: Trusts allow for the centralised management of diverse assets, making it easier to monitor and grow wealth. Trustees can be appointed to manage the trust on behalf of beneficiaries, ensuring that assets are managed in line with the trust’s objectives and the beneficiaries’ best interests.

Real-World Examples of How Trusts Can Hold and Grow Assets

- Holding Rental Properties in a Family Trust: Mark and Susan are property investors with several rental properties. Instead of holding these properties in their personal names, they set up a family trust. This structure allows them to distribute rental income to their two adult children, who have minimal other income, reducing the overall family tax burden. The trust also provides protection for these properties in case of personal liabilities.

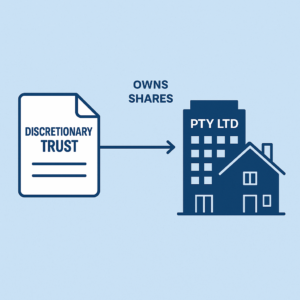

- Intellectual Property in a Business Trust: Samantha owns a software development company and has developed several proprietary software products. She places these IP assets in a discretionary trust. This ensures the IP is protected from business creditors and makes it easier to license the software to other businesses. As a result, Samantha’s company can distribute licensing income from the trust to different family members or related companies for optimal tax outcomes.

- Shares and Investments in a Trust: James and Linda want to build a share portfolio to fund their children’s education and future needs. They establish a discretionary trust and purchase shares in various companies. This allows them to hold the shares for the long term, taking advantage of capital growth. When the shares are sold, the trust can distribute the capital gains to their children, who are in lower tax brackets, reducing CGT liability.

Key Benefits of Holding Assets in a Trust

- Protection Against Litigation and Claims: By holding assets in a trust, they are generally protected from personal creditors or business liabilities, ensuring that they remain secure even in challenging circumstances.

- Tax Optimisation: Trusts provide opportunities for tax savings through strategic distribution of income and capital gains to beneficiaries in lower tax brackets.

- Control and Flexibility: You can establish specific terms on how assets are managed and distributed, providing control and flexibility over your wealth management strategy.

- Simplified Estate Planning: Trusts offer a straightforward way to manage and pass on assets, reducing the complexities associated with probate and ensuring assets are transferred smoothly to beneficiaries.

Others

-

October 20, 2025 Buying Property Under Your Personal Name in Australia: Pros and Cons

-

October 18, 2025 Service Trust Business Structure in Australia