Operating Structures for Your Business: How Trusts Can Support Your Business Growth and Protection

Choosing the right operating structure for your business can significantly impact your tax position, asset protection, and long-term growth strategy. In Australia, using a trust as a business structure can provide many benefits, especially for those looking to run their operations efficiently while safeguarding assets.

What is a Business Trust?

A business trust is a legal entity that holds and manages business assets on behalf of beneficiaries. Instead of running your business as a sole trader or partnership, you can use a trust to operate as a trading entity. This structure can help distribute profits, protect assets from business liabilities, and optimise tax outcomes.

Benefits of Using a Trust as Your Business Structure

- Tax Minimisation: Trusts can help reduce overall tax liability by distributing business profits to beneficiaries in lower tax brackets. For example, a discretionary trust allows the trustee to allocate income to beneficiaries who have minimal other income, reducing the total tax paid.

- Asset Protection: Trusts offer a layer of protection between business assets and personal liabilities. This separation is particularly useful if your business operates in a high-risk industry, as assets held in the trust are not owned personally and are less vulnerable to creditors.

- Flexibility in Income Distribution: A trust provides flexibility in how income is distributed. This is especially beneficial when managing fluctuating business profits. You can decide which beneficiaries receive income based on their current tax position, which can optimise the tax outcome for your family or business partners.

- Capital Gains Tax (CGT) Benefits: Trusts can also provide benefits when it comes to selling business assets. Depending on the type of trust, you may be eligible for a 50% CGT discount when holding assets for more than 12 months, making it a tax-efficient structure for long-term investments.

- Succession Planning: Trusts are ideal for succession planning. They ensure business continuity in the event of the death or incapacity of a key individual. Assets within a trust are not subject to the same legal hurdles as personally owned assets, simplifying the transfer of control and ownership.

Real-World Examples

Here are some examples of how trusts can work to your advantage:

- John’s Construction Business: John runs a successful construction business but is concerned about potential lawsuits or business debts. He decides to operate his business through a family discretionary trust. This way, the business’s assets are held by the trust, not him personally. In the event of legal action against the business, his family home and personal assets remain protected.

- Samantha’s Online Retail Store: Samantha started her online retail business as a sole trader but found that high taxes and limited asset protection were holding her back. After consulting a wealth advisor, she transitioned to a trust structure. Now, she distributes income to her husband and adult children, who are all in lower tax brackets, significantly reducing her overall tax burden. The trust also holds business inventory and intellectual property, providing protection from personal liabilities.

- Mark and Emma’s Real Estate Venture: Mark and Emma, real estate investors, use a unit trust to manage their joint property portfolio. With a fixed ownership structure, they can clearly delineate each partner’s share, making it easier to manage profits and losses while preserving the tax benefits of holding assets long-term.

Types of Trusts for Australian Businesses

There are various trust types suitable for businesses, depending on your goals and operational needs:

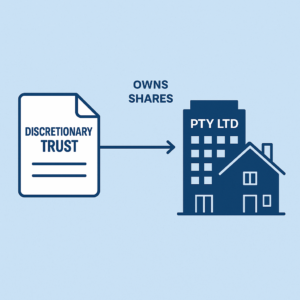

- Discretionary Trust: Allows flexibility in distributing income and provides asset protection.

- Unit Trust: Ideal for partnerships or joint ventures with fixed income distributions.

Others

-

October 20, 2025 Buying Property Under Your Personal Name in Australia: Pros and Cons

-

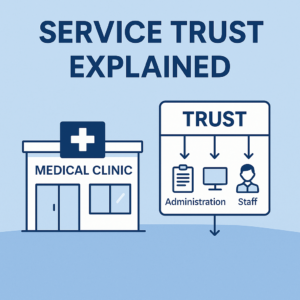

October 18, 2025 Service Trust Business Structure in Australia