Protecting Future Generations: Building a Secure Share Portfolio for Your Children

Michael, a forward-thinking parent, wants to build a share portfolio for his 13-year-old daughter. While he plans to make all the investment decisions now, he envisions a future where his daughter will take control of these investments when she reaches the age of 25. However, Michael is also aware of the potential risks his daughter might face, such as relationship breakdowns or claims from creditors. To safeguard his daughter’s financial future, Michael is considering the use of a discretionary trust. In this blog, we’ll explore how a discretionary trust can provide a secure and flexible solution for building and transferring wealth to future generations, while protecting those assets from potential risks.

The Challenge: Safeguarding Investments for the Future

As a parent, Michael wants to ensure that his daughter’s financial future is secure. He plans to build a share portfolio that she can benefit from in the long term. However, life is unpredictable, and Michael is concerned about the potential risks that could threaten his daughter’s investments. These risks include:

- Relationship Breakdowns: If his daughter gets married or enters into a de facto relationship, the share portfolio could be considered a marital asset in the event of a relationship breakdown, potentially leading to its division or loss.

- Creditor Claims: If his daughter faces financial difficulties or business issues in the future, creditors might seek to claim her assets, including her share portfolio, to satisfy debts.

Michael wants to ensure that his daughter has the security and freedom to enjoy the benefits of the investments he’s building for her, without the fear that these assets could be lost to relationship disputes or creditors.

The Solution: Using a Discretionary Trust for Secure Wealth Transfer

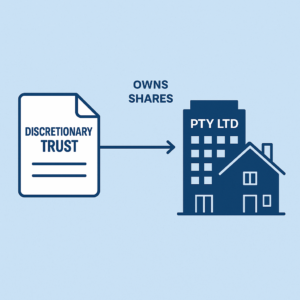

To address these concerns, Michael decides to establish a discretionary trust. This legal structure offers both the flexibility to manage investments now and the protection to safeguard assets for the future. Here’s how Michael can use a discretionary trust to achieve his goals:

- Establishing the Discretionary Trust:

Michael sets up a discretionary trust in which he accumulates the investments for his daughter’s share portfolio. He acts as the trustee and makes all investment decisions while his daughter is still young. This trust structure ensures that the assets are held separately from Michael’s personal estate, providing a layer of protection from any personal liabilities or legal claims he might face. - Transferring Control at the Right Time:

When his daughter reaches the age of 25, Michael can transfer control of the trust to her. This is done by appointing her as the appointor of the trust and making her the director and shareholder of the trustee company. As the appointor, his daughter has the authority to appoint or remove trustees, giving her ultimate control over the trust. By becoming the director of the trustee company, she gains the ability to manage the trust’s investments and make decisions regarding the portfolio. - Protection Against Relationship Breakdown and Creditors:

Since the investments are held in a discretionary trust, they are not considered her personal property. If his daughter experiences a relationship breakdown, the assets within the trust are generally protected from claims by a former partner, as they are not owned directly by her. Additionally, if his daughter encounters financial difficulties, the assets in the trust are protected from potential creditors, as they are held in a separate legal entity. - Incorporating a Lineage Clause:

To further safeguard the trust’s capital, Michael can include a lineage clause in the trust deed. This clause ensures that the trust’s assets remain within the bloodline of the primary beneficiary, Michael. This means that even if his daughter has children or other dependents in the future, the assets will stay protected and within the family, preventing them from being diluted or diverted outside the intended lineage.

Key Considerations: Setting Up and Managing the Trust

While a discretionary trust provides a robust solution for protecting and managing investments, Michael should consider several important factors to ensure the trust is set up and managed effectively:

- Legal and Tax Advice: Establishing a discretionary trust involves legal and tax complexities. Michael should consult with legal and financial advisors to ensure the trust is structured correctly, complies with all relevant regulations, and aligns with his long-term objectives.

- Trust Deed Drafting: The trust deed is a critical document that outlines the rules of the trust, including beneficiary rights and trustee powers. It’s essential to draft this deed carefully to include provisions for the transfer of control, the inclusion of lineage clauses, and any other specific requirements that Michael might have.

- Ongoing Management: Managing a trust requires diligent oversight, record-keeping, and compliance with tax laws. As the current trustee, Michael needs to ensure that the trust operates smoothly and in the best interests of his daughter, adhering to all legal obligations.

The Benefits: Long-Term Security and Flexibility

By using a discretionary trust, Michael can achieve several significant benefits:

- Long-Term Protection: The trust structure protects the share portfolio from potential relationship disputes and creditor claims, ensuring that his daughter’s financial future is secure.

- Tax Efficiency: A discretionary trust can provide tax planning opportunities, allowing income and capital gains to be distributed in a tax-effective manner, potentially reducing the overall tax burden.

- Controlled Transition of Wealth: The ability to transfer control of the trust to his daughter at a specified age provides a structured and controlled way to pass on wealth. Michael can ensure that his daughter is ready to take on the responsibility when the time comes.

Conclusion: Building a Secure Financial Future for the Next Generation

For parents like Michael, setting up a discretionary trust offers a powerful way to build and protect wealth for their children. By using a trust, Michael can invest in his daughter’s future with confidence, knowing that her share portfolio will be safeguarded from potential risks. This strategy not only provides financial security but also offers flexibility in managing investments and planning for the long term.

If you’re considering building a share portfolio or other investments for your children, consulting with legal and financial professionals about setting up a discretionary trust can provide the peace of mind you need. With the right planning, you can secure a stable financial future for your loved ones, protecting their assets for years to come.

Others

-

October 20, 2025 Buying Property Under Your Personal Name in Australia: Pros and Cons

-

October 18, 2025 Service Trust Business Structure in Australia