Protecting Personal Assets as a Business Owner: A Guide to Using Discretionary Trusts

As a successful business owner, John is well aware of the risks and challenges that come with running a company. Operating under a company structure as the sole director, John has built a thriving enterprise. However, with success comes the potential for legal issues and financial claims, which could put John’s personal assets at risk. In this blog, we will explore how John can use a discretionary trust to protect his personal wealth from potential business liabilities and ensure peace of mind for his financial future.

Understanding the Risk: Why Asset Protection Matters

Being a company director carries responsibilities, and while companies are separate legal entities, directors can still face personal liabilities in certain situations. For example, if the company incurs debts or faces litigation, creditors might attempt to pierce the corporate veil and target the personal assets of directors. In John’s case, as the sole director, he is particularly concerned about safeguarding his personal wealth from any unforeseen business liabilities.

The Solution: Using a Discretionary Trust for Asset Protection

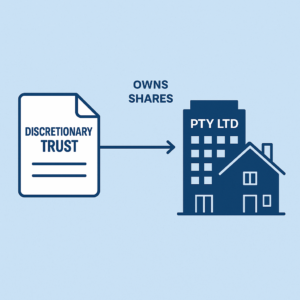

One effective strategy John can use to protect his personal assets is by establishing a discretionary trust. A discretionary trust is a legal arrangement where a trustee holds and manages assets on behalf of beneficiaries. Here’s how it works in John’s scenario:

- Establishing the Trust: John sets up a discretionary trust to hold new investment assets. The trustee, which can be a company John controls or a trusted individual, will manage the assets according to the terms of the trust deed. John, his family members, or other designated individuals can be the beneficiaries of the trust, but no beneficiary has an automatic right to the assets. This means that the trustee has the discretion to decide how the trust’s income and capital are distributed.

- Separation of Assets: By placing new investment assets into the discretionary trust, John effectively separates them from his personal ownership. This creates a legal barrier, making it more difficult for creditors to access these assets if his business faces litigation or financial difficulties.

- Asset Accumulation: Over time, John can accumulate investments within the trust. These could include shares, property, or other income-generating assets. As these assets are not in John’s personal name, they are less likely to be targeted in the event of a legal claim against his business.

Important Considerations: Tax Implications and Existing Assets

While establishing a discretionary trust offers significant asset protection benefits, there are important tax implications and considerations to be aware of:

- Capital Gains Tax (CGT) and Stamp Duty: If John were to transfer existing assets into the discretionary trust, he might trigger CGT and stamp duty. These taxes can arise because the transfer of assets to the trust is treated as a disposal for tax purposes, potentially resulting in a taxable gain. Therefore, it is generally advisable for John to use the trust for new investments only.

- Careful Planning for Existing Assets: If John wants to protect existing assets that are already under his personal name, he should seek professional advice to explore alternative asset protection strategies. Options might include restructuring ownership, insurance solutions, or using other legal structures tailored to his specific situation.

- Tax Efficiency: Trusts can also provide tax planning benefits. Discretionary trusts allow for flexible income distribution, which can be useful for managing family tax obligations. For instance, income can be distributed to beneficiaries in lower tax brackets, potentially reducing the overall tax burden.

Conclusion: Protecting Wealth for the Future

For business owners like John, asset protection is a crucial aspect of financial planning. By establishing a discretionary trust, John can effectively shield his personal investments from potential business liabilities, ensuring that his wealth remains secure and accessible for his family’s future needs. However, it is essential to approach this strategy with careful planning and professional advice to navigate tax implications and make informed decisions.

If you are considering asset protection strategies for your business or personal wealth, consulting with legal and accounting professionals is vital. They can help you design a plan tailored to your unique circumstances, providing peace of mind and financial security for the long term.

Others

-

October 20, 2025 Buying Property Under Your Personal Name in Australia: Pros and Cons

-

October 18, 2025 Service Trust Business Structure in Australia